🏦 Apple, your newest bank?

With the introduction of Apple Card, "Pay Monthly", "Pay Later" and "Pay in Four" the tech giant is blurring the lines between banking and devices.

If you own an iPhone, you are probably one of the 500 million Apple Pay users. It’s easy, and it allows you to leave the wallet and cards at home.

What if instead of using it to pay for your daily supermarket run or bar tab, it would also allow you to:

Pay Apple’s gear in installments (and free of interest)

Apply for personal credit

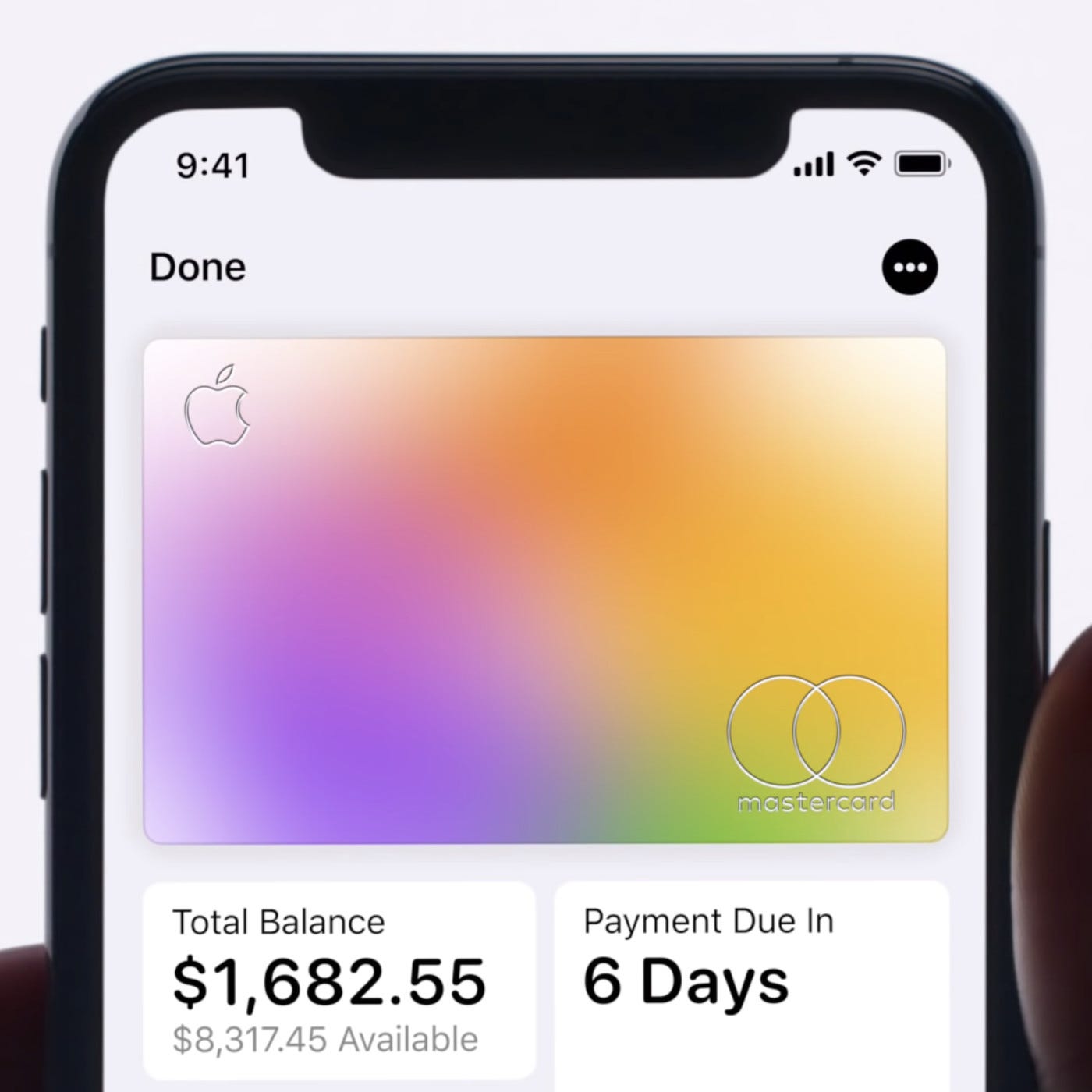

Own Apple credit card

Get rewards in other products and services

Could your phone hardware company replace your bank? Why not?

Pay Monthly, Pay in Four, or Pay Later

Launching soon in the USA in a partnership with Goldman Sachs1 — who will act as the lender — you will be able to buy products and services in full, in monthly installments, or with a delayed interest rate. All without ever speaking to a bank or banking institution, without a credit score check and rivaling the “buy now, pay later” from PayPal.

The service offers the following options, allowing you to move your spending around even if you are not an Apple Card customer:

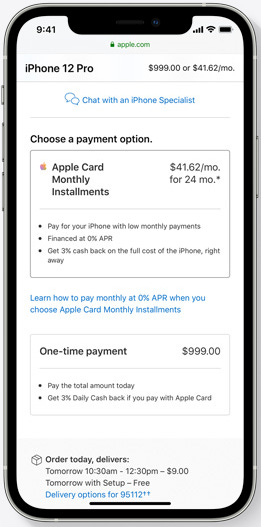

Pay Monthly

Designed for longer-term plans and higher purchases that you want to spread out. Apple did not confirm the service’s interest rate, but with some credit cards or personal loans reaching 30% APR, it can provide a cheaper option.

Pay in Four

It is a simple formula: shop now and pay in four installments every two weeks, interest-free.

Pay Later

This time, you need to submit an application and wait to be qualified for the service. Apple is yet to reveal what the application process entails, but a recent Bloomberg report points out that all you need is an ID and approval for the service. If you use the Apple wallet, Apple already has all the data regarding your cards, spending, and patterns; it will be great to see how the tech giant will do this while keeping users’ data private.